The withdrawal of the US healthcare Bill late Friday has lead to a slight fall in probability of the Fed raising rates again this year.

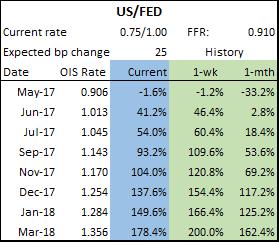

MNI PINCH calculation of probabilities of interest rate change are below:

FED: MNI PINCH still see market pricing no chance of a 25bp rate hike at the next meeting on May 3, but the probability of a hike in June has fallen to

41% from 45% seen last Monday, and in July markets are pricing in a 54% chance of a hike, down from 60%. While the next full 25bp rate hike has been pushed out

to Nov 2017 from Sept, with a further 25bp rate hike now seen in May 2018, according to MNI PINCH calculations.

ECB: MNI PINCH see market pricing in a slightly higher chance of a deposit rate hike at the ECB since last Monday, with the market pricing in a 77%

probability of a 10bp rate hike in December vs 68% previously.

BoE: In the UK, MNI PINCH sees markets pricing in a slightly higher possibility of rise in interest rates as better retail sales and higher

inflation weigh. MNI PINCH calculate markets pricing in a 42.5% chance of a 25bp rate hike in November up from 37% last Monday and a 80% chance of a rate hike by

May 2018 up from 70%.

| |

| Source:MNI/Tradition/Bloomberg | |

read more...